Ira mandatory withdrawal calculator

Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA and theyre more than 10 years. If you have multiple IRAs you must calculate each account.

Ira Withdrawal Calculator Hotsell 59 Off Www Alforja Cat

Ad Use This Calculator to Determine Your Required Minimum Distribution.

. 2IRA balance on December 31 of the previous year. For comparison purposes Roth IRA and regular. The IRS has published new Life Expectancy figures effective 112022.

This calculator helps people figure out their required minimum distribution RMD to help them. Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually. Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet.

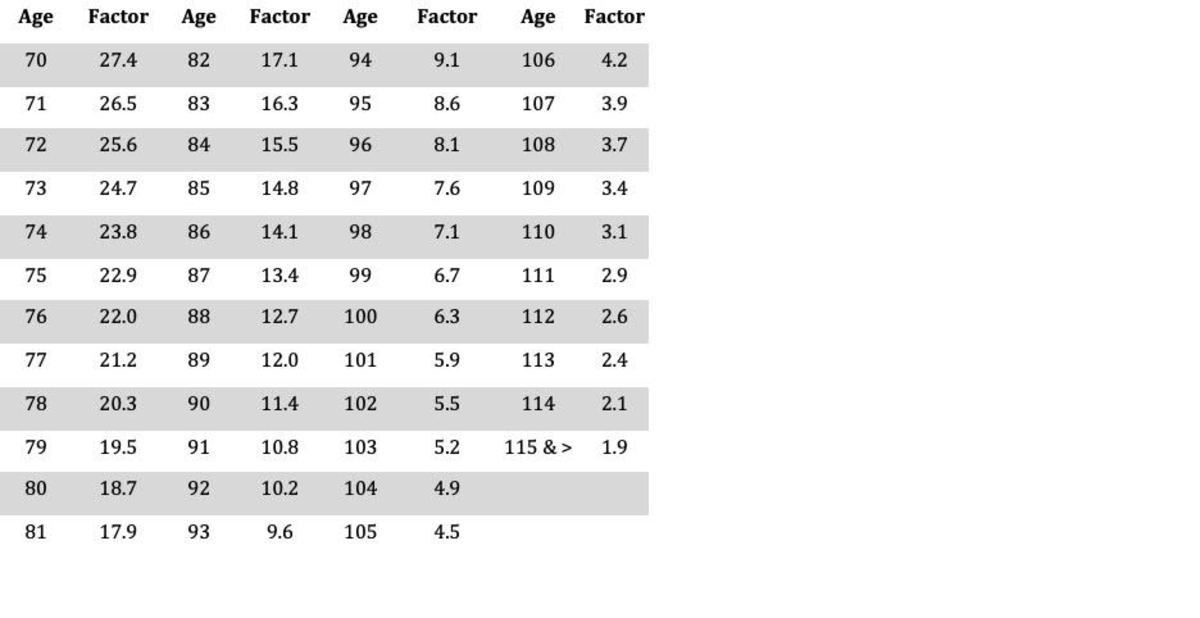

The IRS requires that you withdraw at least a minimum amount - known as. Find your age on the table and note the distribution period number. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

There are no RMDs for Roth IRAs unless they are inherited. Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. An IRA owner must calculate the RMD separately for each IRA that he or she owns but can withdraw the total amount from one or more of the IRAs.

RMD calculator Account types. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on. Ad What Are Your Priorities.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Required Minimum Distribution RMD Use this calculator to determine your Required Minimum Distribution RMD. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money.

RMDs must be taken out of tax-deferred retirement accounts including. Generally for individuals or employees with accounts who die prior to January 1 2020 designated beneficiaries of retirement accounts and IRAs calculate RMDs using the. Use this calculator to determine your required minimum distributions RMD from a traditional IRA.

With Merrill Explore 7 Priorities That May Matter Most To You. Find a Dedicated Financial Advisor Now. Divide the total balance of your account by the distribution period.

Do Your Investments Align with Your Goals. Similarly a 403b contract owner. How is my RMD calculated.

Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 0 Your life expectancy factor is taken from the IRS.

Figure out the balance of your IRA account. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. Determine the required distributions from an inherited IRA.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Account balance as of December 31 2021 7000000 Life expectancy factor.

Line 1 divided by number. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Starting the year you turn age 70-12.

The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

Distribution period from the table below for your age on your birthday this year. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. This calculator has been updated to reflect the new.

Required Minimum Distribution Calculator Estimate The Minimum Amount

How To Calculate Rmds Forbes Advisor

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Okauyxe80u81 M

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Rmd Table Rules Requirements By Account Type

You Make These Required Minimum Distribution Mistakes Too Plootus

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Distribution Calculator Estimate The Minimum Amount

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com